Dear readers, this is our inaugural monthly. We will keep it short, giving the main macro-economic and market structure, mapping the road ahead with clear risks, base-case expectations and actionable investment angles for the next 1–2 months

1. Macro: end of US Quantitative Tightening

The 43-day US government shutdown – the longest on record – has come and gone, leaving behind the usual mess of missing data and general confusion. However – with GDP tracking at 2.9% for Q3 and inflation’s hovering around 3.0% – basically, nothing’s really moved. The US economy keeps chugging along on the back of consumer spending that refuses to quit, even as unemployment edges up to an expected 4.5% by year-end.

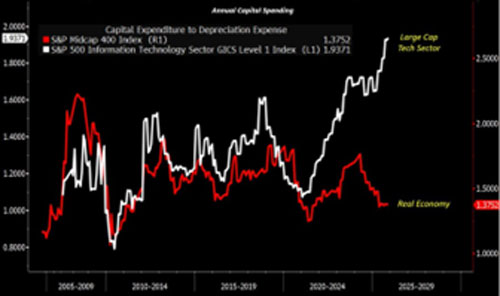

Is this new normal same as the old normal? No. The US real-business cycle is exhibiting a so-called K-shaped behavior, some sectors doing extremely well (tech), other sectors struggling (Figure 1)

More importantly, Dec. 1, 2025 marks the official end of the US Quantitative Tightening (QT). While the FED balance sheet remains 53% higher than pre-pandemic levels of $4.3tn, Goldman Sachs expects a December 10 rate cut is likely sealed, with “little on the calendar to derail” and the US Treasusry has also relaunched its debt buyback program.

These major monetary and fiscal developments usher in more ample liquidity, potentially supporting growth equities, small caps, investment grade credit but also Bitcoin and high-quality cryptos (Ethereum, Solana).

2. Markets: bears are everywhere

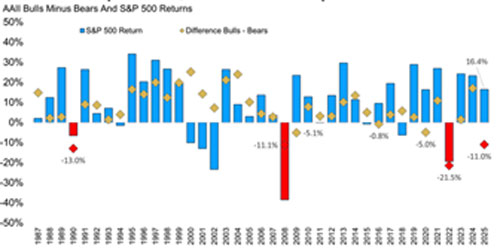

Though the above-mentioned liquidity argument lends support to a constructive view on risk taking, with a month to go, 2025 is unlike any year we’ve ever seen. Usually, we see excitement and bulls in good years, but this year has seen 11% more bears than bulls, an observation which is in line with 1990, 2008, and 2022, all of those having been bear markets and bad years for investors (Figure 2).

In a context of historical high NYSE margin debt ratio and demanding valuation (the Price/Book ratio hit 5.6x, above the 2000 high of 4.6x), this is NOT a market where one wants to deploy risk too aggressively.

3. Investment strategy: participate to the market with tight risk control.

The consensus starts to lean towards a modestly re-accelerating US economic, with growth hovering around 2-2.5% in 2026 due to reduced tariff impact and tax cuts. As capital deepening accelerates and AI/robots are being deployed, the labor market should be softening but no hard landing is expected.

The risks are well known: (1) AI disappointment, (2) inflation resurgence, (3) entrenched US-China rivalry, and (4) debt concerns. However, if growth stabilizes while liquidity conditions improve, provided AI does not disappoint and inflation does not resurge, most strategists are betting on goldilocks while keeping their hedges close.

Peter Lynch once said “far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in the corrections themselves.” We agree with him and will participate to the market while tightly controlling our risk over the next 1-to-2 months. We believe this will remain a market set up where one should buy the dips in high quality names, stay overweight tech/AI beneficiaries, utilities, health care, and banking sectors while investing in the defense sector in Europe and owning some gold as insurance.

IMPORTANT DISCLAIMER

The information, opinions, and analysis contained in this publication (“The View”) are provided by Crosspoint Capital Asia Pte. Ltd. (UEN: 201010341G) for informational purposes only and do not constitute investment advice, recommendations, or solicitations to buy or sell any securities or financial instruments.

Market Commentary & Opinions: All views expressed herein represent the opinions of Crosspoint Capital Asia as of the date of publication and are subject to change without notice. These opinions are based on current market conditions and may not reflect future market performance.

Not Investment Advice: This content should not be construed as personalized investment advice or recommendations tailored to your specific financial situation, investment objectives, or risk tolerance. Investment decisions should be made only after consultation with qualified financial advisors who can assess your individual circumstances.

Risk Disclosure: All investments carry inherent risks, including the potential loss of principal. Past performance is not indicative of future results. Market conditions, economic factors, and geopolitical events can significantly impact investment performance.

No Guarantee: Crosspoint Capital Asia makes no representations or warranties regarding the accuracy, completeness, or timeliness of the information provided. We do not guarantee any specific investment outcomes or returns.

Please refer to disclaimer page for further details.